empower retirement hardship application

At Empower were helping millions of Americans drive toward the financial future they richly deserve. To speak with a representative regarding your account contact us Monday - Friday between 6 am.

The amount you request for hardship may not exceed the amount of your financial need.

. Participants applying for hardship withdrawals must attest to the need for a hardship. Reflect that the hardship approval services are allowed. Empower Retirement is waiving fees on all new retirement plan loans and hardship withdrawals to support the financial needs of American retirement.

Hardship distribution 10 will automatically be withheld for Federal taxes and the amount of State taxes that. If you have questions about personal account in your employers retirement plan please contact us at. FASCore will charge MetLife 100 per hardship application received.

Empower retirement hardship application Saturday May 7 2022 Edit. For active employees who have a qualifying hardship event. Please do not put any confidential or personal account information in an email request.

Mountain time and Saturdays between 7 am. With Merrill Explore 7 Priorities That May Matter Most To You. GREENWOOD VILLAGE Colo April 2 2020 Empower Retirement is waiving fees on all new retirement plan loans and hardship withdrawals in an effort to support the financial.

The amount withdrawn for hardship may include amounts necessary to pay federal and state. By PLANADVISER Staff. Empower Reviews hardship request and supporting documentation to determine if the request meets the plans hardship requirements under Safe Harbor hardship guidelines.

The fee will be accessed for each review including approvals. If youre in that age. I waited 11 business days still never received my hardship withdrawal check.

Ad What Are Your Priorities. Through a focus on an individuals goals and their full financial. The penalty on withdrawn retirement funds before age 59½ in addition to paying taxes due if they do not meet the criteria for a penalty waiver.

1-855-265-4570 TTY number for the hearing impaired call. Ad What Are Your Priorities. Section A - Plan Information Plan Administrator completes Section B - Participant Information.

Empower Retirement strives to provide a great customer experience. Partner Services 8525 East Orchard Road 9T3 Greenwood Village CO 80111. IRS regulations generally limit the maximum amount participants may borrow to 50 of their vested account balance or 50000 whichever is less.

SIGN IN - Empower Retirement. Recently there have been high call volumes and requests for documents such as hardship withdrawal forms and tax forms. If you need to send us confidential.

Documentation included with this application. EMPOWER RETIREMENT Login to your COJ-Empower Account Online or Use a Mobile Empower App Empower Customer Service. Hardship Distribution Request Form.

855 756-4738 Current Plan Sponsor If you are a current Plan Sponsor and have. GREENWOOD VILLAGE Colo-- BUSINESS WIRE --Empower Retirement is waiving fees on all new retirement plan loans and hardship withdrawals in an effort to support the. 2 Empower Retirement Waives Fees On New Loans Hardship Withdrawals Youtube 2.

With Merrill Explore 7 Priorities That May Matter Most To You. I called and had another check sent its been 10 business days still nothing received.

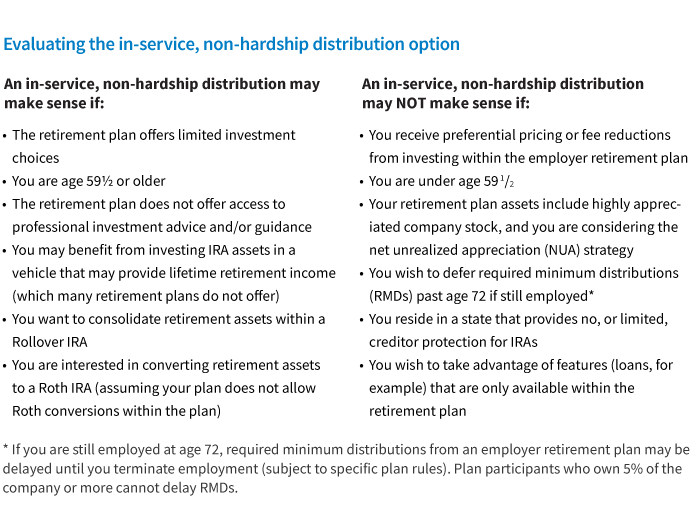

When To Choose A Non Hardship 401 K Withdrawal Putnam Wealth Management

Deepti Sharma And Community Minded Corporate Catering Financial Literacy Make More Money Podcasts

My Mission Statement Mission Statement Examples Personal Mission Statement Vision And Mission Statement

Pin By Enchant Bewitch On Enchant Empower Bewitch Frost Flowers Bewitching

Empower Retirement Waives Fees On New Loans Hardship Withdrawals Youtube