where do i pay overdue excise tax in ma

Web 3 Rosenfeld Dr. They also have multiple locations you can pay including.

Web Excise tax is an annual tax on motor vehicles under Massachusetts General Laws Chapter 60A.

. Web How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Web How often do you pay excise tax in MA. Payment at this point must be made through our.

Corporate excise can apply to both domestic and foreign corporations. You need to enter your last name and license plate number to find your bill. Excise tax bills are prepared by the Registry of Motor Vehicles and billed.

You can pay someone elses tax liability using your card. The excise rate is 25 per 1000 of your vehicles value. What happens if you dont.

Please contact the treasuercollectors office or our Deputy. Web Where Do I Pay Overdue Excise Tax In Ma. Web How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

The tax is due on the 15th day of the third for S corporations. Excise tax bills are due annually for every vehicle owned and registered in Massachusetts. 355 east central street franklin ma 02038.

The tax is levied in lieu of a personal property tax by the municipality of principal. If you dont make your. Web Generally all corporations operating in Massachusetts both foreign and domestic need to pay corporate excise tax.

Web For joint filers please make sure that you enter the Social Security number of the first spouse listed on the tax return. Please use this page to search for delinquent MOTOR VEHICLE EXCISE TAX bills. The Massachusetts Registry of Motor Vehicles prepares bills.

Web You pay an excise instead of a personal property tax. Website disclaimer government websites by civicplus. Web Excise tax bills are due annually for every vehicle owned and registered in Massachusetts.

Web Town of Bourne 24 Perry Avenue Buzzards Bay MA 02532-3441 508 759-0600 Office Hours. Web General Excise Tax as a Deduction However Massachusetts is one of the states where excise tax is classified as personal property tax which means you can claim it on. Web Massachusetts law sets a minimum assessment at 5 even if calculations produce a lesser amount.

How to file an excise tax abatement. Deputy collector pks associates inc. Motor Vehicle Excise Tax.

Excise tax bills are prepared by. Web Massachusetts imposes a corporate excise tax on certain businesses. Monday-Friday 830 am to 430 pm Terms of Use Government Websites by.

Web When you fail to pay a motor vehicle excise a tax collector can collect the delinquent excise by placing marking your vehicle registration and operating license in. Visit their website here. If the motor vehicle excise.

Web To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. Web You can pay your excise tax through our online payment system. Web IF YOUR LICENSE IS SUSPENDED YOU MUST PAY WITH CASH OR MONEY ORDER.

Request for Tax Information. Current Fiscal Year Tax Rate.

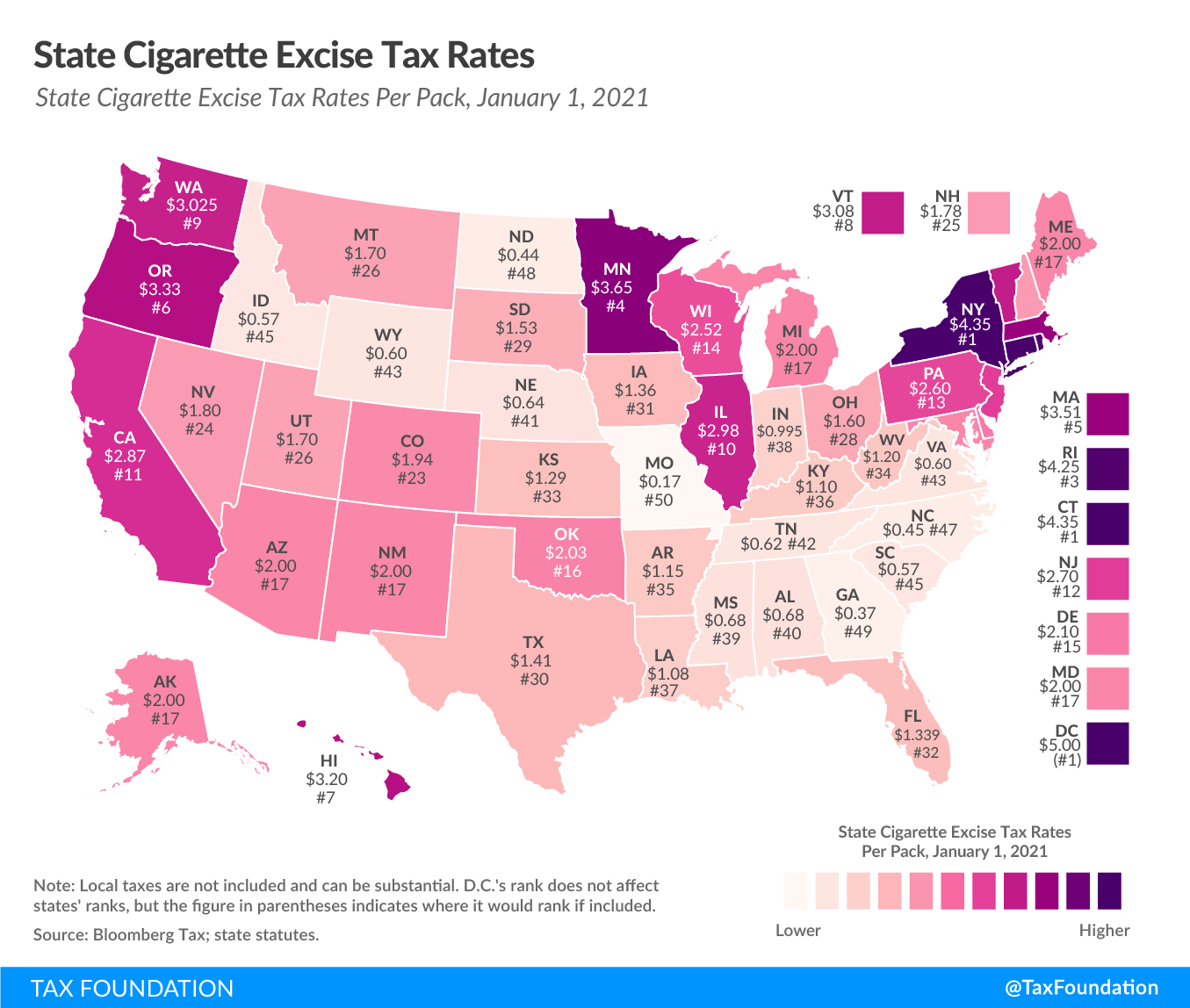

Excise Taxes Excise Tax Trends Tax Foundation

How To Pay Your Motor Vehicle Excise Tax Boston Gov

Motor Vehicle Excise Tax Mve Winchester Ma Official Website

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

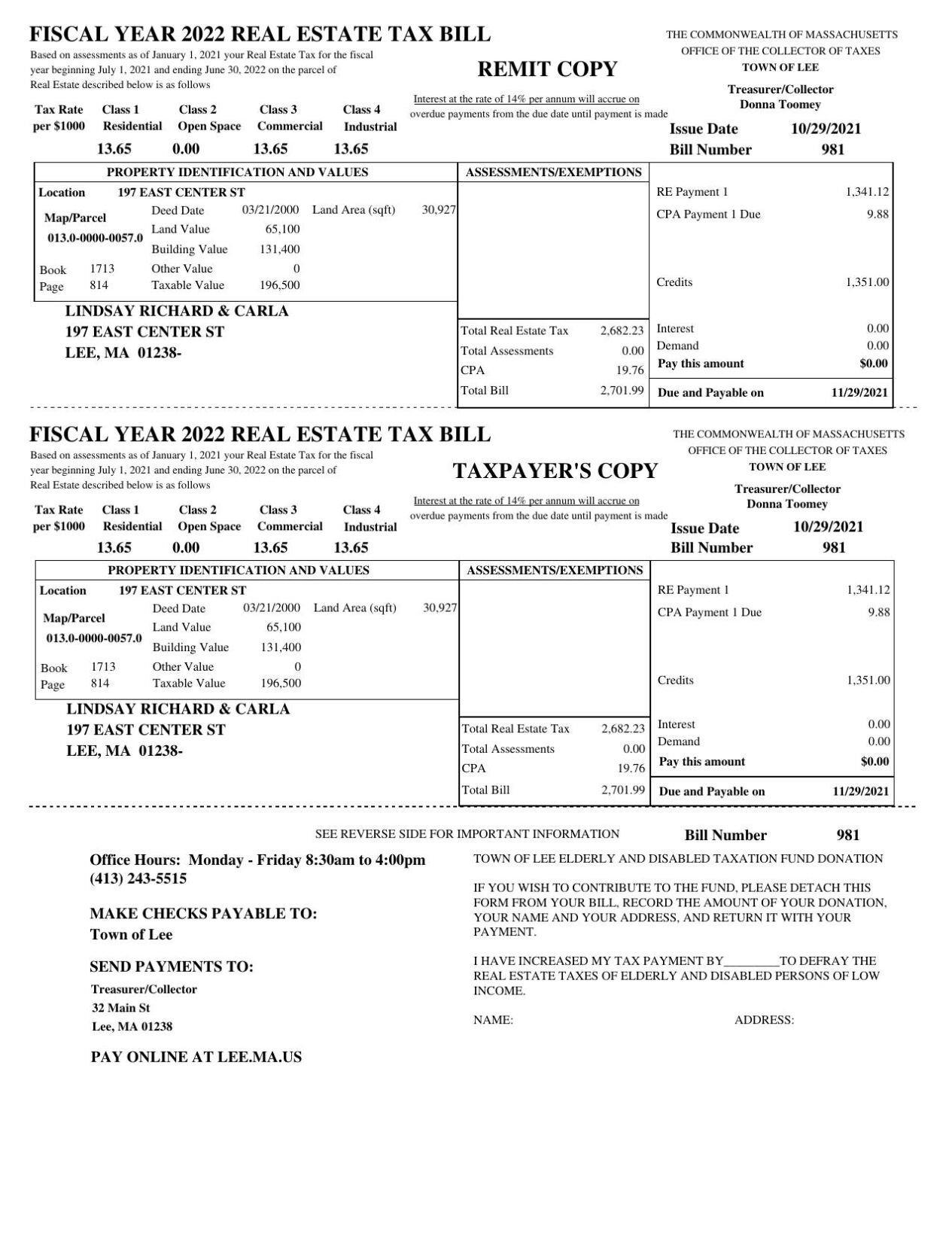

6 Things To Know About Your Property Tax Bill If You Own A Home In Berkshire County Local News Berkshireeagle Com

Massachusetts State Tax Updates Withum

Massachusetts Ifta Fuel Tax Requirements

Look Up Pay Bills Town Of Arlington

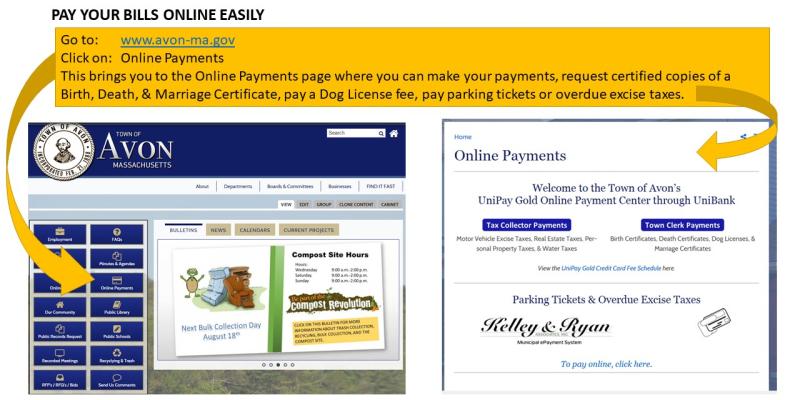

Online Payments Watertown Ma Official Website

2021 Motor Vehicle Excise Tax Bills Fairhavenma

2022 Motor Vehicle Excise Tax Bill Mailed Fairhavenma

Motor Vehicle Excise Taxes Royalston Ma

Motor Vehicle And Boat Tax Boston Gov

Excise Taxes Excise Tax Trends Tax Foundation